What is an Alternative Asset?

Alternative. The road less traveled. Unconventional. Against the grain. Under the radar. The appeal of choosing an alternative route is motivated by one thing: the thrill of discovery. In all genres; music, fashion, or wealth building, we’re all seeking an overlooked treasure, passed over by mainstream hunters.

Before jumping for a metal detector and hitting the beach, it’s worth knowing when it comes to making money, there are more reliable, and more lucrative options for treasure hunting.

Related: Southwestern Ontario Farmland 101: Productive Farmland as an Alternative Investment

Don’t restrict your investments to the fickle temperament of public markets. Look beyond mainstream stocks and bonds to grow your wealth.

In finance, alternative investments exemplify diversification and lower volatility. Because they function with low correlation to publicly traded stocks and bonds, alternative investments can cushion your portfolio from the ever swaying market trends.

Alternative Asset Classes

Real estate

This is usually the first category that comes to mind when discussing alternative assets. Real estate includes residential and commercial properties, such as farmland, as well as REITs (real estate investment trusts). As an asset, real estate includes the land and whatever fixed structures it holds.

Commodities

Commodities are the marketable goods produced for consumers, regardless of who produces them. Commodities are a popular investment choice because they are tangible and of high economic importance. The main categories are energy, metals, agriculture, and livestock.

A diversified and curated portfolio can look just as fruitful as a trove of rare collectibles.

Collectibles: This is the glamorous class of alternative assets. Fine wines, priceless art, precious gems and metals, first edition iconic books; these are rarities with high value.

Scour your home library for these books, maybe you’re already sitting on a gold mine. If not, keep reading about other alternative asset classes.

Foreign currency

Fairly self-explanatory, foreign currency is currency from outside the home country of the investor.

Insurance products

This includes life insurance and annuities.

Derivatives

These are when the behaviour of interest rates or other assets create value in the form of financial contracts. The contracts may cover futures, forwards or options.

Venture capital

As per the name, venture capital is high risk. But for wealthy investors, it can mean high reward. This is the money invested for small businesses and startups with promising potential for long term growth.

Private equity

This is a direct investment into private companies and is not quoted publicly. Private equity can raise capital to fund new technology, research and acquisitions.

Distressed securities

This is an investment that can rescue a company undergoing, or on the verge of bankruptcy. Acquisition may be inexpensive, but the risk is high unless the company’s potential has a higher value than what the market has determined.

The Accredited Investor Advantage

In any exclusive club, there are perks and there are parameters. For accredited investors, these parameters are necessary for navigating a landscape of complex investments, especially in the absence of a financial advisor. The perks can streamline wealth building; an accredited investor can potentially enjoy higher rates of return, in less time.

Accredited investors can enjoy hunting for the rare investment opportunities on their own.

As an individual, you could qualify as an accredited investor in Canada if you meet at least one of these criteria…

1. Income

In both of the previous two years, and anticipated for the current year, your net income has exceeded $200,000 before taxes.

OR

Combined with your spouse, in the past two years and expected in the current year, your net income exceeds $300,000 before taxes.

2. Financial Assets

Your liquid assets are worth more than $1 million before taxes. This includes public equity, cash or bonds and can be combined with your spouse as well.

3. Net Assets

Your net assets, alone or combined with your spouse, total at least $5 million, with liabilities deducted.

4. Other

You were, or presently are, a registered advisor or dealer.

Strike Alternative Asset Gold: Rich Farmland

Investing is like eating. To grow your wealth, feed your portfolio a well-balanced diet. So supplement your public market investments with healthy alternative assets. What’s healthy? Low risk. What’s tasty? High returns. Generally, if you aren’t well acquainted with the menu of alternative assets, you’ll want to choose lower risk categories with solid historical returns. Investing in farmland is a great option to work up your appetite.

Farmland literally feeds you —but it can also feed your financial gains.

Investing in agriculture is a timeless, and highly prospective option. In regions with preferable growing conditions (sunshine, water, healthy soil and infrastructure aplenty), the profitability is promising. Another important consideration is the insatiable global demand for agricultural products. There are billions of people to feed, but unfortunately we have declining space for arable land.

Our existing arable land is increasingly valuable.

Here’s where Canada enters the picture…

Alternative Investment Frontier: Canadian Farmland

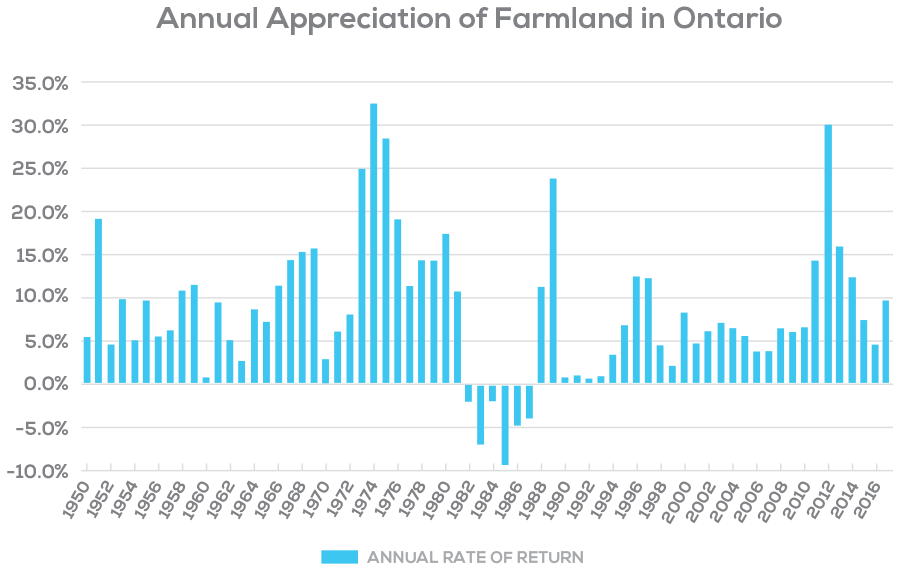

While the future is uncertain, it is a safe assumption that as the price of food increases, the value of land that produces it will follow suit. Farmland values in Ontario have risen in all but six of the past sixty-seven years.

The numbers say it all: the value of farmland has continued to appreciate in Ontario over several decades.

We believe that Ontario farmland is now poised to capitalize on converging trends that will be an integral part of the world’s food production system for years to come. This further emphasizes the stability of Canadian farmland as a sound investment.

Southwestern Ontario Farmland: Conservative and Alternative

If expanding your portfolio to alternative asset classes is an idea you’re exploring, do your research. The thrill of an alternative route doesn’t mean you should go barreling down a torrent of rapids after you fork away from the mainstream. Understand the risks and rewards. Steer clear of anything that smells like a get-rich-quick scheme. Look at tangible, conservative options with good historical returns.

Agriculture and farmland are promising investments, especially in the most productive area of Canada: Southwestern Ontario. AGinvest offers a viable starting point for your budding alternative investment journey. Start mapping out your investment strategy with us.